A brave new world: Oil and architecture

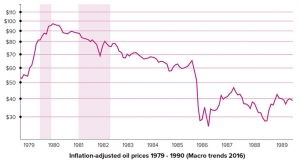

Innovations in low energy building were spurred in the 20th century by oil crises, but the political impetus for meaningful change receded once the crises ended, explains Dr Marc Ó Riain, bringing an attendant failure to set meaningful building regulations.