- Economy

- Posted

Local custom

With money leaving local economies across Ireland to service debt and significant drops in local authority revenues, towns such as Dundalk, Ennis and Kilkenny are investigating the possibility of bringing in electronic currencies to keep money circulating locally, as Richard Douthwaite reveals.

Alabama's main economic engine, Jefferson County, has laid off 1,000 public employees and closed courts, a prison and some sheriff's offices for lack of funds. In Phoenix, Arizona, hundreds of police and firemen have been dismissed and old people's day centres, libraries and sports complexes closed. Tulsa, Philadelphia, Rhode Island and Michigan are among dozens of American communities which have taken, or threatened, similar steps.

The financial pressures on Irish local authorities are not quite so extreme but painful cuts are having to be made here too and, nationwide, 5,000 council workers have already lost their jobs. In County Louth, for example, 130 people, a tenth of the workforce, have gone.

Bernie Woods, Louth's head of finance, says that those who have left fall into two categories. One consists of older, experienced people who either retired or opted for early retirement to secure their pensions. “A lot of knowledge has been lost,” she says. The other group was mostly made up of recent entrants – bright, enthusiastic young people with new ideas - whose short-term project-based contracts were not renewed. Both types of loss are bound to affect the council's ability to perform.

Most of the 150 or so people who have left Galway City Council's employ would fit into those categories and the same is probably true for every council in the country. Of the 80 or so people who no longer work for Kilkenny County Council, several had 25-30 years experience in the planning and engineering departments. Clare County Council has reduced its 2010 wages bill by €2.3 million, or about 5% less than its 2008 level, by not filling 115 permanent and several seasonal posts, and by cutting overtime.

Part of the reason for the staff cuts is that the €870 million general purpose grant which central government will share out this year among all the country's local authorities is 13% below its 2008 level. This grant comes from road tax with a central government top-up. It is now slightly less than the councils received in 2006 and is money which can be spent at their discretion. In a normal year it would make up about a fifth of the income that a typical council had available for current, as opposed to capital, spending.

The Department of the Environment points out that about half the €130 million cut in this grant is offset by the councils' new source of income, the €200 a year charge on second homes. However, all the other sources of council income are going to be down this year too by amounts which will only be known with certainty in December. Even the total amount of the other central government grants and subsidies, which typically provide about 23% of a council's income, is still unknown because the figures for the various programmes, such as the maintenance of national primary roads, environmental services and higher education, have yet to be announced. For example, this year's funding for rural water schemes was to be revealed in the third week of April, after this magazine had gone to press.

Green Party councillors Brain Meaney, Malcolm Noonan and Senator Mark Dearey are all in favour of launching community currencies

In the past, commercial rates have provided about a quarter of a typical council's income but estimating how much they will be this year is a problem because, with firms going out of business or cutting back, there are many more vacant properties. In addition, cash flow difficulties mean that the amounts due are harder to collect. “We're collecting in a very difficult climate. We try to work out flexible payment methods when we can,” says Ger Dollard of Clare County Council. Michelle Robinson of the Office for Local Government management says that the four Dublin local authorities have budgeted to collect 6.9% less in rates this year than last. However, this figure can only be a guess until the money is actually in.

Rents and waste and water charges which normally provide about 30% of a council's income are going to be seriously down this year given the lower levels of commercial activity and higher levels of financial hardship among council tenants. Even parking fees and fines, which used to be a nice little earner for Ennis town council, have dropped off sharply. “I think it's because people are more conscious of the cost and with less business in town, more legitimate parking spaces are available,” Ger Dollard says.

It's not just payrolls which are being cut in response to the decline in income. “The first things to go were all those things that made being a councillor particularly worthwhile,” says Malcolm Noonan, the mayor of Kilkenny. “For example, we've had to call a complete halt to buying new books for the library.”

He is particularly upset about the big reduction in the city's arts budget but says that the most damaging cuts were made to the community and enterprise budget which will end the Revitalising Areas by Planning, Investment and Development (Rapid) programme. This aims to improve the quality of life and the opportunities available to residents of the city's most disadvantaged estates.

He is also concerned that far too little is being spent on water and waste water infrastructure, both nationally and in Co Kilkenny, to meet the EU's Water Framework Directive deadline, December 2015. “In most cases, systems in this county will fail,” he comments.

Due to decreased revenue, county councils have taken to filling-in potholes instead of resurfacing the road

Bernie Woods also says that “the nice things to do have been stopped” and that her council's spending on library books is severely restricted. She adds that the frequency of some services in Co Louth has been reduced but that nothing has been cut completely – yet. “We are looking at cuts,” she says. “We're under strain, delivering all the services with fewer people.”

Kilkenny, Clare and Louth are all saving money by doing less maintenance, although dangerous situations are not being allowed to develop. Major refurbishment projects have been deferred and cheap-and-nasty methods are being used for some smaller jobs. For example, potholes are just being filled rather than the road being completely re-surfaced. In Louth, old pumps are not being replaced with ones which would use less electricity and leaky old water pipes are being renewed less quickly.

“Anything with a long-term payback is ruled out. We are storing up problems for the future,” Woods says. “We can continue like this for three to four years but in five years' time, a lot of our infrastructure will have to be completely replaced because we will not have done adequate preventative maintenance.” Interviewed independently, Malcolm Noonan and Ger Dollard say the same thing in almost the same words.

It's a situation that was all too familiar in the 1930s. On the one hand we have people who want to work, and councils that would like to employ them. On the other hand, we have communities, councils and a national government which would like the work to be done. In the 1930s many community currencies were launched, particularly in the US. Is that the solution this time?

Well, Dundalk, Ennis and Kilkenny all have a Green Party councillor who thinks that if their county helped launch an electronic currency which could be used locally to supplement the euro, its financial straightjacket would ease appreciably. The three – Malcolm Noonan in Kilkenny, Brian Meaney in Clare and Senator Mark Dearey in Dundalk – have been urging their officials to look at the feasibility of this approach.

Ger Dollard, director of services at Clare County Council

I must declare an interest here because the currency system in which they are interested – a liquidity network – was developed by a Feasta working group in which I play a part. The group's motivation was its belief that the supply of euros will get scarcer still because, as I have argued before in Construct Ireland, they are created when people go into debt and cancelled when those debts are repaid. It may be many years before ordinary folk and businesses feel it wise to increase the amount they owe because of their present high level of indebtedness.

If that's the case, a non-debt-based form of money will be needed, so we've designed our new currency to ease the euro's scarcity by supplementing it with a second, complementary currency, the quid, which will be given, rather than lent, into circulation. It will be for local use but will free up euros for external transactions.

Quid will not be given away for nothing. They will only go to users who are building the currency's usefulness and acceptability and, because all transactions are electronic, the system's managers will know who they are.

In the early stages, the most important users will be the local authorities in the area in which the quid circulates. Accordingly, the interim organisation set up to launch a local system - every liquidity network will be run by a local trust made up of trustees charged with representing the users' interests – will give each local authority an advance on the quid it is expected to qualify to be given over the first few months of the system's operation.

In return, the councils will commit themselves to accepting quid at par with the euro in payment for their local charges, including rates, council house rents, refuse and water charges, parking fees, betterment levies and motor tax. This commitment will run until a local authority has either earned the quid it was advanced or returned any unearned portion to the trust.

One way the councils will spend their advances u is by persuading their employees to accept part-payment of their wages in quid. We expect the employees to agree because they will know that many shops in the area will accept quid at par with the euro and also that they will be given extra quid by the local trust the first few times they carry out quid transactions. They will also know that using the new money will enable the councils to employ more people and provide more services than would otherwise be the case. In other words, if they accept quid, they will make their own jobs safer.

The local traders will know that if they accept quid, they can always use them to pay their rates and other council charges. However, we think it will be competitive and social pressures which compel them to join the system. If they don't take quid, other shops will instead, thus gaining extra business and showing their commitment to the community.

The quid's basic circulation is therefore from the councils to their employees, from the employees to the shops, and from the shops back to the councils. However, that circulation won't do very much good by itself and the success of the network depends on those who receive quid finding other ways to spend them. So, for example, shop owners should offer their staff and local suppliers part-payment in quid. If they do, the trust will be able to give them a bonus because the increase in the network's turnover they generate will require more quid to go into circulation.

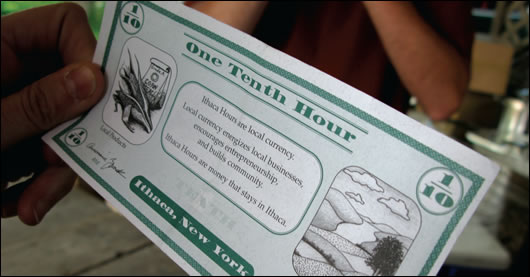

The Ithaca Hour, a paper note local currency in circulation in Ithaca, New York state, since 1991

In short, although quid are given into circulation, they are given to those who have helped develop the system or, like the councils, promise to do so. This is as it should be since the value of a currency is created by those who use it. I will not accept payment in a new money from you unless I know I can pass it on quite easily to someone else, who in turn will need to know that they can spend it easily too. In view of this, a liquidity network rewards people who find new ways to pass its units on or who spend them in larger amounts with the same people.

Giving these bonuses is easy because all the trading records will be kept on one well-backed up computer server. Everyone using the system will need to have an account. One option is to give them a card containing a radio frequency identification (RFID) chip or a sticker containing a chip which they can attach to their mobile phone. They will be then able to make small payments just by tapping the card or their phone on a special pad while larger payments will require the use of a PIN as well.

Users will be able to check the balance in their accounts on their mobile phones and to pay others via their mobiles as well. The local trust's server will send a text message to their mobiles whenever they earn a bonus payment.

No-one will be able to get credit in the system. If you want to pay a hundred quid and there's only fifty quid in your account, then fifty is all you can pay and you will need to make up the difference in euros. Not allowing debt is a great advantage as it makes the system much easier to operate since credit checks are not required and users don't have to be chased through the courts to recover bad loans.

The initial advances to the councils will be paid according to the level of trading they are expected to do in quid in the first year and the number of people and companies that they are expected to involve. Once a council has “earned out” its advance, it is no longer obliged to accept quid at par with the euro and can alter the exchange rate.

Any user who has been rewarded for achieving u a certain level of trading who then averages less trade for a specified period will find that the local trust slowly claws back some of the quid they were given to return their float to the level appropriate for their current trade.

This would allow the total number of quid in circulation in a contracting system to be reduced, an essential feature because every type of money has to be kept scarce if it is to retain its value. If ever the euro became so abundant again that people no longer wanted to be bothered with using the quid, it would be possible to use a combination of the monthly account fee the trust will charge and the penalties on slowing accounts to withdraw quid from circulation and thus wind the system gradually down.

Giving expanding users more quid and removing them from contracting accounts is only possible because all transactions are made via the internet and mobile phones or through a dedicated terminal. Of the three places that are considering having systems, Dundalk appears to have an edge because it is one of two towns in the country (the other being Tuam) which has had Zapa terminals installed in a hundred shops to make it easy to run local loyalty schemes. These terminals recognise RFID chips and allow payments to be made instantaneously. Dundalk people are already putting euros on to their Zapa cards to make small payments so they don't have to be bothered carrying cash.

Zapa is an Irish technology start-up company and has agreed to collaborate in the launch of a liquidity network, so the Dundalk shops which have its terminals will be able to accept quid payments without having to purchase additional equipment and find space for it on their counters or checkouts. This is ideal as it will allow our system and its software to be tried out on a small scale without significant capital investment. Later on, other communities will be able to choose whether to use RFID terminals or not.

If we go ahead in Dundalk, we will keep Kilkenny and Ennis abreast of progress so that their systems can start with little delay. The introduction of a liquidity network to an area breaks the link between the level of economic activity that it is possible to carry on there and the amount of money that the community has borrowed or earned from outside. A liquidity network enables an area to:

- Build its local economy by developing its local trading links. Many jobs could be created by meeting local needs with local skills and resources.

- Lessen the burden of mortgage payments and other types of loan service. As the same amount of euros will still be coming into the area, the payments made in quid are likely to be in addition, rather than instead of, payments in euros. Since the quid can be used for local payments instead of euros, it will leave more of the latter available for payments for which only euros are acceptable. As a result, the level of bad debts and rates and loan arrears should decline in areas with liquidity networks.

- Settle invoices more quickly. Because users are rewarded for their turnover, there is every incentive to settle accounts as quickly as possible.

- Lower business costs. If a business is given part of its working capital by its local trust rather than having to borrow it from its bank, it will save part of its interest costs.

- Local firms prepared to take payment in quid will have an advantage over outside firms which have no means of spending them.

The upside could be enormous. The downside is one of scale. The councils' bonuses need to be sufficiently large to justify the work they will have to put in to set up a parallel accounting system. The bonuses also need to be large – equivalent to a million or more euro – to do much good. Yet, to be safe, a liquidity network has to start small and expand only when the inevitable teething problems are overcome. As much as anything, whether the first system is launched in Dundalk, Ennis, Kilkenny or anywhere else depends on the willingness of the local authority's finance people to act as guinea pigs and co-develop the system in the knowledge that, if it fails, there probably won't be a second chance.

The liquidity network website is at www.theliquiditynetwork.org .

A brochure can be downloaded from http://bit.ly/liquidbrochure

There is also information and discussion on the proposal at http://bit.ly/liquidnet

Breaking new ground

The complementary currencies used in the US during the Great Depression in the 1930s worked so well that Professor Russell Sprague of Harvard University advised President Roosevelt to close them down because the American monetary system was being “democratized out of [the government's] hands.”

The currencies spent into circulation by provincial governments in Argentina in 2001 when the peso got very scarce also worked well. They made up around 20% of the nation's money supply at their peak but were withdrawn in mid 2003 for two main reasons. One was pressure from the IMF, which felt that Argentina would be unable to control its money supply, and hence its exchange rate and rate of inflation, if the provinces continued to issue their own monies. Another, more powerful, reason was that the federal government felt that the currencies gave the provinces too much autonomy and might even lead to the break up of the country.

But these US and Argentinean monies were all debt based. So are the regional currencies using paper notes which are operating successfully in Germany – they derive their value from the euro which backs them 100%. The only currency I know of that is given into circulation is the Ithaca Hour, which has circulated in Ithaca, New York state, since 1991 and led to the launch of similar systems elsewhere. However, as Hours are paper notes, there is no means of withdrawing them from circulation if the level of trading contracts.

So, although mobile phones are being used for making national currency payments in several countries, there is no electronic debt-free system operating anywhere in the world.

Related items

-

Green shoots for green building

Green shoots for green building -

Green groups critical of latest budget

Green groups critical of latest budget -

Passive house costs falling, new study finds

Passive house costs falling, new study finds -

Reaching for the first rung

Reaching for the first rung -

Green finance must be longterm & sustainable — Ecology

Green finance must be longterm & sustainable — Ecology -

Irish construction industry has long opposition to higher standards

Irish construction industry has long opposition to higher standards -

Free training in low energy building starts this month

Free training in low energy building starts this month -

Conference hears of urgent need to upskill Irish construction workers

Conference hears of urgent need to upskill Irish construction workers -

Better Building conference hears commercial property warning

Better Building conference hears commercial property warning -

Glasgow to host conference on passive house at scale

Glasgow to host conference on passive house at scale -

Glen Dimplex open new Irish R&D facility

Glen Dimplex open new Irish R&D facility -

Bord Gáis calls it quits on home insulation business

Bord Gáis calls it quits on home insulation business