- Economy

- Posted

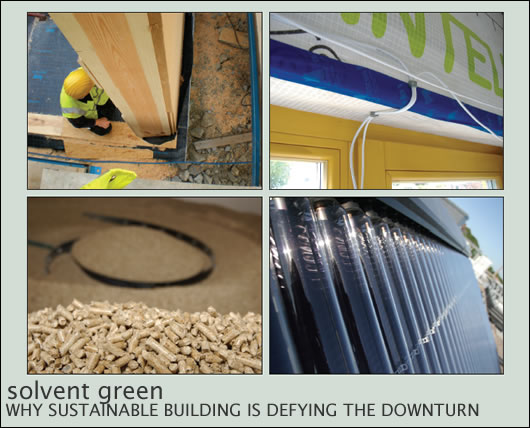

Solvent green

The market for new residential build may have bottomed out, but compared to the rest of the construction industry the sustainable building sector appears buoyant. Changing market conditions, various government incentives and updated building regulations are all helping greener building companies - but with few houses likely to be built this year and capital restricted, challenges still lie ahead. Lenny Antonelli reports

It’s stating the obvious to say that the market for new housing has collapsed, with the number of house completions falling from a high of over 93,000 in 2006 to less than 52,000 last year. This only tells part of the story though, as work on many of the houses finished last year began while the boom was in full swing. Commencement notices - declarations to local authorities that house building is about to start - provide a clearer picture. Over 75,000 were registered in 2006, but less than a third of that were filed last year.

Fewer than 20,000 houses could be built this year according to the Construction Industry Federation, who predict that 55,000 construction jobs will be lost by 2011. The mood in the sector is decidedly glum.

At the same time however, the green corner of the building industry appears buoyant. "The green sector is very much staying alive," says Bill Quigley of NuTech Renewables. "People have money but they're scared to spend it. If people were considering putting in a new bathroom, they might think twice because there's no return. If they have a few bob lying around, rather than leave it sitting they can get a much better return by putting it into the whole area of renewables and energy saving."

Tom Barbour of leading building product suppliers MacCann and Byrne tells a similar story. "The only growth we've seen last year, and so far this year, has been in the green side of the market. It's holding its own. If we looked at the figures across our product range the only growth is in natural insulation and green materials."

MacCann and Byrne's subsidiary Ecological Building Systems is a popular supplier of sustainable building products. Barbour says the company's hemp and cellulose insulation, and Intello air-tightness system, are amongst its top sellers.

Most of the companies Construct Ireland maintains contact with say business remains steady. "Our business is going strong and that's because we're in a niche market," says Matt Jordan of Eco Glaze, specialists in high performance windows and doors. "Our sales are still going strong. They're down a little but not by a massive amount on last year."

So why do things appear comparatively rosy for greener companies? The change in market conditions has certainly played a role. During the boom years, a sellers' market prevailed - over-valued housing and an abundance of buyers meant most new dwellings were sub-standard and overpriced.

Now, with buyers thin on the ground and developers struggling to sell, those that are buying are asking more questions about energy performance, and demanding more for their money. "I think if you look at what's being offered by builders...they're reducing the price and enhancing the product," says Tom Dunne, head of DIT's school of real estate and construction economics.

Matt Jordan agrees. "In a recession people ask, 'what's the best I can afford?' If they're going to do something, they're going to do it once and do it right." Tom Barbour believes consumer awareness is growing too. "More and more people are looking at products that give added benefit in terms of energy savings and health. Those are questions people are now asking and understanding."

While the shift to a buyers' market has benefited the green building sector, the relative buoyancy of the market for one-off housing has been a factor too. While the number of 'scheme' houses completed fell from more than 50,000 in 2006 to just over 21,000 last year, the number of individual house completions dropped from less than 23,000 in 2006 to over 17,000 last year - a much softer landing. "Self-builders tend to do their own research so they can get good performance and high quality," says Jay Stuart, managing director of leading sustainable design consultants DW EcoCo.

Matt Jordan of high performance door and window specialists Eco Glaze at the Eco Build section of Plan Expo 2008. “Our business is going strong and that’s because we’re in a niche market,” he says. “Our sales are still going strong, they’re down a little but not by a massive amount on last year.”

But government incentives have arguably been the biggest stimulant to the sustainable building sector. Since launching in March 2006, the Greener Homes scheme has grant-aided the installation of almost 20,000 renewable energy heating systems so far, providing a significant boost to the market for domestic renewables and raising public awareness of solar, biomass and geothermal heating.

"The Greener Homes scheme has introduced renewable energy to Ireland in a big way," Ernst Postuma of renewable energy specialists Solarcon told Construct Ireland last year. "I drive through the countryside in west Cork and I see a lot of solar panels on roofs."

Other grants have boosted green building too. SEI's House of Tomorrow program grant-aided the construction of 4,000 low-energy homes over a five year period, while the Warmer Homes Scheme has to date supported the admittedly rudimentary energy upgrade of over 10,000 low income dwellings.

The recently announced national insulation program for economic recovery includes e50million worth of energy upgrade grants for homeowners [under the Home Energy Saving scheme] and e50 million for the renovation of low income and social housing. In spite of the current economic conditions, the grants should provide a significant boost to companies supplying grant-aided technologies such as insulation, efficient boilers and heating controls. The introduction of Building Energy Ratings should boost green building too, though to what extent remains unclear.

In November, the Department of Communications, Energy and Natural Resources announced a major expansion of a scheme that allows companies purchasing energy efficient equipment to write off the cost against corporation tax. The scheme now covers boilers and ventilation systems, lighting and lighting controls, as well as biofuel conversion kits, electric vehicles, and microgeneration equipment. The announcement, as Construct Ireland goes to press, of a 19c feed in tariff for the first 4,000 farmers and homeowners to sell micro-generated electricity to the ESB, is an additional bonus for a fledgling sector.

While government incentives have undoubtedly boosted the sustainable building sector - and can continue to help keep it afloat - building regulations have played a major role too. The revisions to Part L of the regulations last year demanded 40 per cent reductions in energy demand and carbon dioxide emissions associated with space heating and domestic hot water, and made renewable energy mandatory in all new residential build, with an air-tightness testing requirement thrown in for good measure.

An important point to remember here is that during the years of prolific construction industry output, sustainable building didn’t really get much of a look in. Developers didn’t need to build to a high standard in a seller’s market, and did the relatively sub-standard building regulations at the time didn’t force their hands to build well. Now on the other hand, not only do houses have to integrate renewable energy systems and consume 40 per cent less energy, but they must be pressure tested to prove they’ve been built as air-tight as their BER calculations assume. As a result, a large amount of the sub-standard materials and technologies which were used so prolifically during the boom can’t be used for new homes now. With that in mind, it’s little wonder that the sustainable side of the industry is relatively unaffected. Further improvements to building regulations in 2010 and beyond should provide still more help in this regard.

“The only growth we’ve seen last year, and so far this year, has been on the green side of the market,” says Tom Barbour of Macann and Byrne

“My view on the building regulations is that they're the minimum standard," Jay Stuart says. "In the 21st century they're out of date by the time they're implemented because things move so quickly. The time between revisions to Part L is getting shorter and shorter."

"I think the whole country on all sorts of levels, including the public and builders, realises that we've got to build better buildings and look at renewable energy," he continues. "It's not going away and they have to deal with that, so there's less resistance. Some companies have realised that it's another profitable business opportunity. And with BER fully in force, they have something that helps them to market what they build if they do a better job."

"The current fall in the cost of energy is temporary," Stuart says. "I think the difference in price will likely be made up by a carbon tax anyway. That will further stimulate the sustainable side of the building industry."

But with the economic situation likely to worsen further, and unemployment to increase, it will become increasingly important for developers and self-builders to meet tough new standards cost effectively. Likewise, renovators will seek to reduce their energy bills for as little outlay as possible.

Stuart believes tackling air leakage is the most cost effective way to reduce energy demand. "Air-tightness gives you the best return on your investment," he says. "It can reduce energy costs by 20 to 30 per cent. But you cannot do it unless you put in designed ventilation. The two are inextricably linked and should never be done in isolation."

After air-tightness, Stuart says installing heating controls and an efficient boiler are the most cost effective energy reduction measures, referring to research by Tipperary Energy Agency showing that effective heating controls can reduce heating bills by up to 47 per cent. He says that insulation, then high performance glazing, offer the best value after that. Stuart also refers to e35 inflatable chimney balloons as a cheap way of reducing energy demand - the device is installed via the fireplace and prevents warm air from escaping or cold air from infiltrating via the chimney, and can simply be deflated if a fire is being lit.

If it seems the green building sector is buoyant in Ireland, we're not alone - research in the US points to a similar trend there. Despite the downturn, four out of five of developers surveyed in a recent study by McGraw-Hill Construction anticipated a growth in sales associated with green building, while a majority of those surveyed said they expected 60 per cent or more of their projects to be focused on green building by 2013. Likewise, US eco-building consultancy Yudelson Associates has predicted the sector will continue to grow as energy refurbishment, water conservation and renewable energy become increasingly important parts of the US policy agenda.

But while the sustainable building sector appears steady at home and abroad, it is changing. As demand for new build collapses, renovation is becoming an increasingly important source of business.

"It's mostly refurbishment that we're doing. People want to know how they can get their home warmer," says Mike Cregan of Greenspan, suppliers of a wide range of sustainable building materials. Cregan says external insulation products are currently his biggest sellers. "We're promoting them and advertising them the most. The refurb market is the growth area we want to get into, it's definitely a growing market. We're finding that 10 to 15 per cent of customers don't even care about grants."

"There's a huge reaction to ordinary people [wanting] to insulate their houses better," he says. "If you give the proper leadership and advice the guy on the street will follow through. With the advent of BERs people are now becoming aware."

Shane Miller of Quality HRV paints a similar picture of the shift to renovation. "We were doing 80 per cent new build and 20 per cent refurb last year, but now it's about 50-50," he says.

Bill Quigley agrees that the market is changing. "We're focusing now on what we see as target markets. In the past we've done a lot of spec houses, with spec builders, where the houses would be built by the 20, 50 or 100. That market is gone now and will probably stay gone for some time, and if it ever comes back it will probably be in 10s or 20s at most."

"We realise there are 1.5 million houses in the country. We have an integrated [solar thermal and HRV] system that can be put into those houses to help them get up the BER scale," he says.

“I think the whole country…realises we’ve got to build better buildings and look at renewable energy,” sustainable design consultant Jay Stuart of DW EcoCo says

Nutech Renewables’ solar collectors on the roofs of Leahy Brothers housing development at Killeagh, County Cork

Jay Stuart believes the end of the boom has caused a shift in consumer demand. "The focus is now is more likely to be on reducing energy demand. During the boom period, people were probably prone to buying bolt-on renewables. That's putting the cart before the horse though. There's no point doing that unless you're going to reduce your energy demand."

But while the green sector may be relatively healthy, it's still likely to face serious challenges. The collapse in the market for new build and the difficulty homeowners face getting bank loans are bound to have an impact.

"The biggest problem is that people can't get the money," says Matt Jordan. "We've had customers putting their order in and then being let go, so they kind of hold back. People’s budgets aren't as big as they used to be. That's one thing that's catching us out." Tom Barbour agrees lack of capital is a problem. "There's just no money out there and people aren't spending. The green side isn't big enough to prop up the standard side yet."

The collapse in the residential new build market has hit new green build too. Interest in SEI's Low Carbon Homes scheme - which provides grants for developers to build low energy homes - has been poor, according to Ivan Sproule of Sustainable Energy Ireland. SEI are currently reviewing their strategy to stimulate interest in the scheme.

"The first reason is the current state of the market," Sproule says. "The second is the cost of taking the extra step forward [in energy performance]. We're in a market that's demanding lower prices. To achieve those zero carbon targets that we're talking about you have to put in some form of microgeneration, and that's expensive."

"There's no return for a builder except to say that he's pushed up the rating on the house to a certain level," he adds. "But will that sell a house? Is it still not all about place, place, place? Energy prices are relatively low and I think that's another barrier as well."

But while it's inevitable that the collapse in new build will have some knock on effect on the green building sector, there are still plenty of reasons to be optimistic. Part L is set to be updated again next year, and a zero-carbon standard for new build is expected by 2013. Such developments can only boost the green building sector.

"We all know what the end game is," Jay Stuart says. "Fundamentally we want houses that don't need heating systems. Then renewable energy can provide most of the hot water and some of the electricity."

International developments should help too. As climate change moves further up the global political agenda, further government initiatives to reduce carbon emissions from buildings can be expected, particularly as Barack Obama's administration has indicated a willingness for the US to finally tackle the issue. And with fossil fuel prices set to rise in the long-term, reducing household energy demand remains one of the smartest investments around.

Of course it's foolish to presume that every building-related company with a green tint will survive. The ones that do will be those offering quality at decent prices, and who approach the market in innovative ways. More and more companies in the sector are teaming up to offer renovation packages to householders that include insulation, efficient boilers and renewable energy.

For Bill Quigley, offering energy upgrade packages make sense. "There's no point in pumping in loads of solar energy into an uninsulated, draughty house," he says. In spite of current economic conditions, a combination of quality products, smart packages - and of course government and regulation incentives - can help quality green building companies survive, and thrive, in the difficult times ahead.

- Articles

- economy

- Solvent green

- recession

- downturn

- sustainable

- construction

- energy prices

- Low Carbon Homes scheme

Related items

-

Energy poverty and electric heating

Energy poverty and electric heating -

Green shoots for green building

Green shoots for green building -

Green groups critical of latest budget

Green groups critical of latest budget -

Towards greener homes — the role of green finance

Towards greener homes — the role of green finance -

Quinn Building Products rebrands as Mannok

Quinn Building Products rebrands as Mannok -

Iso Chemie Winframer gets BBA approval

Iso Chemie Winframer gets BBA approval -

Passive house costs falling, new study finds

Passive house costs falling, new study finds -

New digital construction platform launches

New digital construction platform launches -

New Leeds developer goes passive

New Leeds developer goes passive -

Stunning Cork passive house heads list of Isover award winners

Stunning Cork passive house heads list of Isover award winners -

'Achieving NZEB' event in Cork this Thursday

'Achieving NZEB' event in Cork this Thursday -

Reaching for the first rung

Reaching for the first rung