- Economy

- Posted

Lost property

Richard Douthwaite proposes a new bank-free, debt-free way of financing property purchase and development to get the market working again and clear up the mess left by the bubble.

Ireland has a vast oversupply of almost every type of building. No-one knows exactly how big this oversupply is but here are some attempts to establish its order of magnitude:

Housing: between 228,000 and 280,000 houses are vacant at present if holiday homes are ignored. Perhaps 150,000 of these are in excess of the number that would be vacant in a normally-functioning property market. If that figure is roughly right, the oversupply is around 7.5% of Ireland's total housing stock of around two million.

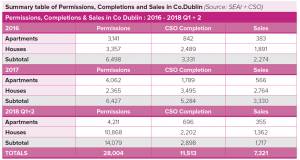

Office space: 21% of Dublin office space – some 782,500 square metres – is also vacant, according to Savills, and a further 110,000 sq m is due to be completed this year. When it is, the total amount of vacant space will be almost as large as Dublin's entire office stock was at the end of 1990 - 1,055,490 sq m. With this extra space, the oversupply will be 27%. No figures are available for the rest of the country but any oversupply there seems less serious.

Factory space: no vacancy figures have been published recently but the overhang is likely to be small as very few manufacturing units – as opposed to small warehouses – were built on spec. However, an oversupply could develop as existing firms close down.

Retail space: by the end of this year there will be over two million sq m of shopping centre space and 1.32 million sq m of retail park space in the state. As this is double the amount of retail space occupied in 2005 and incomes could well return to their levels that year, perhaps only half of the current stock will be needed in future.

Hotel rooms: at the end of 2008 there were 905 hotels with 58,467 rooms, 26% of which – 15,000 rooms – is said to be more than the demand warrants.

Building this excess capacity entailed an investment of at least €100 billion which is now being taken over by the people of Ireland as a result of the bank bail-out. The surpluses listed above are becoming our surpluses. As we will be paying for them through our taxes for many years, we have a legitimate interest in enquiring how the assets we are buying are being looked after and in deciding what should be done with them. This article will explore both issues.

First: is our property being protected and maintained? While building work was going on, the development companies made sure that the things they paid for were protected from the weather and generally maintained. But when the developers' banks refused further funding and the contractors left the sites because they could no longer be paid, part-built structures were usually left just as they were, with no attempt being made to mothball them against the day that construction could begin again.

In the months since then, the partially-finished buildings have deteriorated and may need to be demolished altogether. Professor Rob Kitchen of the National Institute for Regional and Spatial Analysis at NUI Maynooth – which brought out a report on ghost housing estates in July – thinks that all the timber-framed buildings left open to the weather for more than a few months will probably have to be cleared.

Architect Joseph Little agrees. He points out that if the timber's moisture content has stayed above 20% for a period then “serious structural decline” is likely to have begun, especially in the unventilated conditions within walls where fungi could thrive. “25 to 30% of the houses built recently were timber frame,” he says.

There are up to 280,000 vacant houses throughout the country, around 7.5% of Ireland’s total housing stock

He is also concerned about the condition of unfinished concrete block houses: if the walls become sodden and internal insulation is applied when work resumes, it might be years before the wall dries out and, until it does, mould may flourish and its spores damage the occupants' health. Similarly, if the house has cavity walls, dust, sand and pebbles can get into the cavity during the hiatus and cause dampness and heat loss in the finished building.

”We ought to be checking the health of families who have already moved into houses where the building was stalled for a long period,” he says. “I'd be happier about completing those houses whose building got no further than the basic slab.”

The banks are either unaware or unconcerned about the fact that unfinished buildings deteriorate when left for months on end and that, as a result, their value to them as security for the loans they have advanced declines. Gerard O'Toole of Tuohy O'Toole in Westport – who has been valuing Nama-bound property for one of the major banks – says that he assesses what the current market value of each house might be if it was finished, and then deducts the amount he estimates that it would take to complete it. Consequently, if its fabric has deteriorated since work ceased, the bank will be paid less for it.

This seems fair enough until one realises that if Nama pays the bank less, the bank will suffer a bigger loss and will need a bigger capital injection from the state to achieve its target capital-adequacy ratio. In other words, the public pays for the deterioration either way. Moreover, once the property is transferred to Nama the deterioration will go on as it will be some years before work recommences – if it ever does. O'Toole cannot imagine circumstances in which work on properties transferred to Nama would resume in less than three years after it ceased.

During the research for this article, I asked two of the banks involved with Nama about the care of buildings against which they had loans secured. Cora Whyte of Group Corporate Communications, Bank of Ireland, refused to comment at all and questions I subsequently e-mailed to her boss, Dan Loughrey, went unanswered.

The public relations firm employed by the second bank, which preferred not to be named, issued a brief statement which made it clear that the bank never took any responsibility for the maintenance and public liability insurance of property developments it had financed. The responsibility always lay with the developer unless the bank had put in a receiver. “In receiverships, third-party companies are appointed by the receiver (which is in turn appointed by the bank) to maintain properties and ensure public liability [is] in place. In this situation, the responsibility lies with the receiver/third-party companies,” part of the statement read. A very detailed list of questions put to Nama was unanswered as this article was filed (Ed. – a reply came in just before the magazine went to print and is published at the end of this article).

Not all stalled developments will end up with Nama, of course. The smaller ones on which under €5 million is owed will stay with the banks, as will completed projects against which the banks still have outstanding debt. Any deterioration to these will also be at the public's expense even after the banks become profitable again – assuming they ever do. This is because before their return to profitability, the public may have to inject funds into the banks to make good their losses due to property write-downs, while afterwards the cost of the deterioration would be set against tax.

So what is to happen to this rag-bag of completed and part-completed building projects which the public either owns outright through Nama and its ownership of Anglo Irish Bank and the Irish Nationwide Building Society, or part-owns through its shareholdings in Bank of Ireland and AIB? This question only arises because the property market has ceased to work. If it still functioned, it would deal with the excess supply by bringing down prices until the market cleared – in other words, until the excess had disappeared.

It's worth exploring just how it would do that. As property prices fell in relation to people's incomes, some existing home-owners would decide that they would like to sell their present houses and buy new, bigger and better ones. The general fall in property prices would mean that they would get less for their current houses, of course, but, thanks to the price fall, their incomes would allow them to finance the difference. In other words, they would be trading up, just as the people buying their old houses would be doing. The initial sale-and-purchases would set off chains of trades in which everyone moved into a house more suited for them and only the worst houses, right at the end of the chains, would be left unoccupied, perhaps for demolition. That's a highly desirable outcome. The same thing would happen with retail and office space. As rents fell but incomes stayed constant, businesses would be able to afford to move to the better locations, leaving bad property empty.

So the best possible way of dealing with the property surplus is to get the market working again. Then, at least, if any property was to be left empty or demolished, it would be because no-one had any use for it at even the lowest rent or purchase price.

Some of the RRI project houses used for resettlement

But Nama was set up quite deliberately to stop the market working. It is essentially a way of selling property into intervention, just as butter and cheese was in the 1970s, to be stored on refrigerated ships anchored around the Irish coast. At least those responsible for the butter realised that it would go rancid unless they paid the storage costs. Nama has yet to have this thought.

If Nama had not been set up, the banks would have appointed many more receivers who would have sold off properties for whatever price they could get. The resulting flood of property onto the market would have driven prices down a long way, particularly if the banks were grudging about making finance available to would-be purchasers. But the outcome might have been a lot better than the present situation. The banks would certainly have made losses but they have made those anyway while, on the positive side, the surplus buildings would have found their way into the hands of people who had a use for them and would look after them. In addition, property prices would have found their floor.

Having such a floor is important because three things are needed for a working property market on conventional lines. One is that potential buyers/lessees are confident that property prices and rents are not going to fall, leaving them either in negative equity or paying a fixed rent that makes them uncompetitive. That confidence is lacking at present and Nama is partly to blame. The second requirement is that potential buyers/lessees are sufficiently confident about their future income stream to be happy about taking on long-term commitments. That confidence is also absent at present. And the third necessity is the availability of long-term finance at affordable interest rates.

Getting just one or two of these requirements right is not enough. All three have to be correct and it is hard to see them being so for several years even if you don't share my view that, now that the peak in the world's production of easily-extracted oil has been passed, the days in which we could expect rising incomes year after year have gone for good. Instead, I think incomes will shrink and that no-one will wish to borrow at a fixed interest rate. As that would be just like putting your head in an ever-tightening noose, new ways of financing must be found.

Leaving the question of whether or not growth will resume aside, what should we do about the property overhang in the next few years while the market isn't working? There are two possible approaches. One is to try to devise a new type of market. The other is to work outside the market altogether. Let's look at both.

James Pike, the chairman of O'Mahony Pike Architects and a former president of the RIAI, has been exploring a possible new market mechanism with an accountant who has considerable experience in property development, Kieran Ryan, and a solicitor, Kevin Ryan. The trio have been looking at the community land partnership ideas put forward by Chris Cook of the Nordic Enterprise Trust in Scotland as a result of a lecture Cook gave in Dublin in 2008. (The lecture is on video at http://www.vimeo.com/5639127)

“Cook's model shares some features with current tenant-purchase schemes and rent-to-buy schemes but provides a much more flexible framework,” Pike says. “It offers an alternative path to property ownership and a stake in the management of developments for all tenants. It also presents a very stable and secure development model which should be attractive to pension and other investment funds.”

The model involves setting up an ‘equity partnership’ in which all the participants have ‘equity shares’ which are millionths of the flow of rentals to be paid by the occupiers. Thus, with a new development, the landowner would get shares for his/her land, and the investors for their capital. Once the development was complete, the occupiers would pay rent in money or ‘money's worth’ of services for the use of the capital which had been invested.

The initial rent would be set at an affordable level and would rise or fall according to an agreed index of inflation. The occupiers would also pay for the maintenance/depreciation and possibly heating of their buildings. The developer or a management company would run the development in return for equity shares in the rents. If occupiers chose to pay more than the basic rent, the extra would be invested in equity shares and they would build up stakes in the property in which they lived. Once they had acquired enough shares, the income from them would cancel out the rent they had to pay. If they owned equity shares and ran into problems paying the rent they would be able to sell off shares to meet the shortfall.

“Investors who have seen their income dwindling as interest rates head towards zero should be extremely interested in an investment such as this,” Chris Cook says. “Equity shares offer an index-linked return based on property. There is a very low risk that the return will not be paid since affordable rentals are by definition more likely to be paid. Equity shares are a perfect investment for risk-averse investors such as pension funds. In particular they are perfect for Islamic investors since no debt or interest is involved.”

Pike and his team have calculated the costs and returns for three projects in the Dublin area for an article “Using equity partnerships to rescue building projects hit by the downturn” which Feasta, the sustainability NGO through which I work, will publish next month as a chapter in a book, Fleeing Vesuvius. They show that in current conditions, returns to investors of 2.5 – 3% are possible. As a result, Pike hopes that equity partnerships will take over some of the apartment blocks which developers, desperate for cash, have let under rent-to-buy arrangements.

“The arrangement has big advantages for occupiers,” he says. “They can own their own dwellings, in time, without having to borrow. They can also have an input in the management of the development as a member of the equity partnership: something they would not have as a renter of an investment property. They become members of a community of stakeholders with shared objectives. This should make for more stable tenancies, greater security of tenure and a better experience for the occupier than they would get in the private rental sector.”

It is possible to imagine banks, or even Nama, putting property into equity partnerships in exchange for shares. Private investors and pension funds would then put up any capital required for completion or to provide additional facilities to make occupation an attractive proposition. All that is necessary before this can happen on a large scale is for a brokerage firm to spot the opportunity and undertake to make a market in equity shares. This is necessary as otherwise investors would be worried about having problems getting their money out.

The sale of equity shares could replace the banks as a source of funds for property development and acquisition, while at the same time allowing them to climb down from the grotesquely over-exposed property position they built up during the boom. Over 80% of the loans the banks made in 2006, for example, were property-related. As a result, 63% of the loans they had outstanding at the end of last year were to do with property whereas only 1.8% were to manufacturing industry. This extreme imbalance needs to be unwound and the banks could do so by selling equity shares to investors once the partnerships had begun operating.

By providing finance and not locking people into debt or fixed rentals, equity partnerships could get the property market working again. They could be used to clear almost all of the property overhang although the income the banks and Nama would get from their equity shares in some projects would be tiny. The solution to this is that a cut-off point should be established and, whenever it looks as though u their income from a property will fall below this threshold, the second type of solution, the outside-the-market one, should come into play. In most cases, this would simply entail the low-return property being given to the community in the area in which it stands although outside voluntary organisations should also be eligible to receive it.

The argument for taking this course is that the community is already paying for the property through its taxes and it may be able to find a way of using it that will bring benefits even though these may be largely of a non-monetary kind. Provided that a suitable non-profit organisation can be found which is eager to take ownership, giving a property away is likely to produce a much better outcome than leaving it to moulder away on Nama's or a bank's books in the hope that, some time in the future, an upturn will come and the investment will come good.

The sculptor Jim Connolly thinks that local authorities should not qualify as community organisations eligible to receive such properties. If estates of vacant houses in rural areas cannot be placed in equity partnerships, they should not be used for social housing as it would amount to “apartheid for poor people,” he says.

Connolly set up Rural Resettlement Ireland in 1990 in an effort to stop rural depopulation and decline and has since been responsible for helping over 700 families to move from social housing in the cities to privately-rented houses in the countryside. As a result of this experience, he believes using ghost estates for social housing would be a mistake.

“Tenants would be sent there,” he says. “They would be given no choice but they would not want to go to places with no work, no facilities and no public transport. The environment would crucify them. They would become problems.”

Connolly, who published a book in 2008, The Enforced Urbanisation of Ireland, believes that local authority planners must take a lot of the blame for empty estates in rural areas. “With applications to build individual houses in the country, they insisted that applicants had to prove that they needed to live there. With the big estates, no-one was ever asked to demonstrate housing need.”

Rural Resettlement Ireland has found that the families it helps to move usually want a house with a garden and a shed which can be used as a workshop – things they may have been denied on the estates from which they have come. They also want to mix with the local community and this happens naturally because only one or two families move into a parish at a time.

Fr Harry Bohan also believes that incomers have to be integrated. He set up the Rural Housing Organisation in 1973 to get young families to live in Feakle, the village in which he was born. RHO built 20 houses there, the most it built anywhere, even though it subsequently constructed 2,500 houses in 120 villages in 13 counties. “We always sized our developments in relation to the size of the village,” he says. “We also had programmes to integrate the old and the new residents every Monday night.”

Having a local organisation rather than the local authority own and manage an estate of houses would help integration while the rents could provide facilities which the whole community could share. This has happened before. In the early 1970s, Connemara West, a newly-established community development organisation in Letterfrack, a remote village in a pretty part of Co Galway, was grant-aided to build a number of holiday cottages to rent out to visitors. The income from this enabled a part-time development worker to be employed which, in turn, led to the running of a furniture design and manufacturing course with funding from the Youth Employment Agency in the grim industrial school which had closed in 1974.

After running the course for five years, Connemara West, which has 600 local shareholders, established a partnership with the Galway-Mayo Institute of Technology in 1987. It has since built a campus in the reformatory grounds where GMIT teaches three degree-level courses – in furniture design, wooden manufacturing technology and, for prospective secondary school teachers, furniture design and technology education. Of course, it isn't entirely an accident that some of the 260 students live in the Connemara West holiday cottages during their terms, although most live in self-catering accommodation owned by local people.

“When we bought the old industrial school people thought we were mad,” says Michael O'Neill, head of education at Connemara West. “But we've doubled the space and are still short.”

The essence of the Letterfrack story is that a community put its vacant buildings to good use. An excellent way of trying to lessen the damage wrought by the property bubble would be for the state and financial institutions to give other communities their chance to do the same.

_________________________________________

Q&A with Nama

Construct Ireland: Has the ownership of all developments for which Nama has taken over the loans been established legally?

Nama: Nama does not take over ownership of developments, it acquires loans which are secured by (typically) property assets. As part of the acquisition & valuation process Nama clarifies title on all securities and where title is deficient, discounts are applied to the prices that would otherwise have been paid for the relevant loans.

CI: In what proportion of the loans transferred to Nama has the title to the property on which it is secured been transferred as well?

Nama: Nama has acquired only loans as yet; where, following review, a debtor is not considered to be viable, Nama will foreclose and will take control of underlying property.

CI: In cases in which Nama has title to a property, what arrangements are made for its maintenance?

Nama: Nama will ensure that borrowers act to maintain the properties they have used as securities for their loans. When it takes direct control of property, it will make its own arrangements.

CI: On many developments around the country, buildings have been left open the elements and are deteriorating. Does Nama hold title to any of these?

Nama: No.

CI: If so, are the properties visited and protective measures put in hand? Does Nama take out public liability insurance on the properties to which it has title?

Nama: See above.

CI: In cases where the developer still has title, what steps does Nama take to ensure that the developer maintains the secured property in good order and has public liability insurance?

Nama: This will be one of the pre-requisites of Nama’s continued support for a debtor.

CI: Are sites visited to check? Is funding for protective work and insurance ever provided in cases in which the developer would have difficulty paying for it?

Nama: This has not arisen to date.

CI: Would you confirm that, when a property is valued for Nama before the loan is transferred from a bank, it is valued on an “as is” basis, so that any deterioration in a building's condition since, say, work on it stopped, is at the expense of the developer or the bank?

Nama: Any such deterioration will be reflected in the acquisition price.

CI: Does Nama have a department which decides whether sites for which it holds title should be completed/developed or mothballed? Does this department also review developers' plans? Does Nama have any qualified planners on its staff?

Nama: Nama will make decisions about the completion or otherwise of projects based on a commercial rationale. These decisions will be taken by the board or the executive depending on the scale of the investment that may be required. The key concern is whether an investment will increase the overall return to the taxpayer. Nama will procure the services of planning specialists as required.

CI: Has any of the €5 billion that Nama has in its budget for completion work been disbursed? If so, details would be appreciated.

Nama: Small amounts have been disbursed as working capital for completion of specific projects. Nama is currently in the process of reviewing debtor business plans. Approval of a business plan by Nama may entail investment by Nama in one or more projects which are assessed to be economically viable.

Related items

-

Green shoots for green building

Green shoots for green building -

A grid of their own

A grid of their own -

Housing for who?

Housing for who? -

Green groups critical of latest budget

Green groups critical of latest budget -

Stirling Work - The passive social housing scheme that won British architecture’s top award

Stirling Work - The passive social housing scheme that won British architecture’s top award -

Passive house costs falling, new study finds

Passive house costs falling, new study finds -

Westmeath NZEB scheme opens its doors

Westmeath NZEB scheme opens its doors -

Reaching for the first rung

Reaching for the first rung -

A housing boom without the houses?

A housing boom without the houses? -

Two houses for the price of one

Two houses for the price of one -

Water, water, everywhere, nor any drop to drink

Water, water, everywhere, nor any drop to drink -

Green finance must be longterm & sustainable — Ecology

Green finance must be longterm & sustainable — Ecology